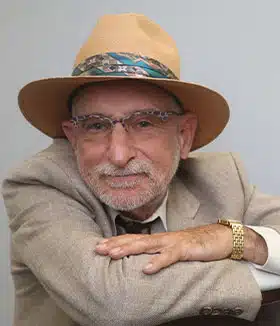

Founding lawyer, David Rotfleisch is an expert in the realm of income tax law.

David J. Rotfleisch is a Canadian tax lawyer with over 38 years of experience advising individuals and businesses facing serious tax non-compliance under Canadian tax law. He is a Certified Specialist in Taxation (Law Society of Ontario) and a Chartered Professional Accountant (CPA, Lifetime Member), a rare dual qualification that allows him to manage both the legal risk and financial reconstruction required in complex Voluntary Disclosure Program (VDP) matters. He is the founding partner of Rotfleisch & Samulovitch P.C., a Canadian tax law firm established in 1987.

A long time focus of David’s practice is the Canada Revenue Agency’s (CRA) Voluntary Disclosures Program and related tax amnesty mechanisms. He advises Canadian residents and non-residents seeking relief from CRA penalties and prosecution while correcting historical non-compliance, including unreported income, undisclosed offshore assets and accounts (T1135), unfiled returns, unresolved GST/HST and payroll liabilities, and multi-year reporting failures.

David manages the VDP process from initial risk assessment through final CRA resolution. His work includes eligibility analysis, disclosure strategy, reconstruction of financial records, preparation of complete and accurate filings, CRA engagement during review, and negotiations relating to CRA penalty and interest relief. His approach is deliberate and risk-focused, recognizing that unsuccessful disclosures can expose taxpayers to CRA tax audit, reassessment, and prosecution.

His combined legal and accounting background is particularly valuable in disclosures involving multiple years, incomplete records, and complex financial activity. David regularly advises on VDP matters involving cryptocurrency transactions, blockchain-based income, platform activity, self-employed taxpayers, cross-border assets, and technology-driven reporting gaps.

In addition to his advisory work, David writes extensively on tax amnesty, CRA enforcement trends, and voluntary disclosure strategy. He is frequently featured in professional publications and mainstream media, and regularly appears on radio and television to explain complex tax issues affecting Canadian taxpayers.